accumulated earnings tax c corporation

He accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding the imposi-tion of income tax on their shareholders by permitting earnings and profits to be accumulated instead of being distrib-uted. If a C Corporation goes over the 250000 accumulated retained earnings cap set by the IRS those earnings become subject to something called the excess accumulated retained earnings tax This is a tax the federal government set up to make sure that C Corporations distribute profits from time to time.

Accumulated Earnings Tax The AET is a 20 percent tax for each tax year on accumulated taxable income of corporations1 While the AET hasnt been widely imposed or litigated in recent years it still applies to all corporations with limited exceptions2 formed or used to avoid the individual income tax.

. Not taking a returns typically makes sense for brand-new or small companies where the money is being reinvested right into growing operations. The point of this tax is to encourage companies to issue dividends to their shareholders rather than sit on the earnings which ironically often leads to the shareholders paying taxes on the dividend. Typical C corporations where shareholders are taxed separately from the company may retain up to 250000 of their earnings before.

Publicly held corporations with many. Exemption levels in the amounts of 250000 and 150000 depending on the company exist. C Corp Accumulated Earnings Tax.

Related

For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000. There is a certain level in which the number of earnings of C corporations can get. EP generated in a C corporation are subject to two levels of taxation corporate and shareholder and retain this character even if subsequently owned by an S corporation.

The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. The accumulated taxable income is the. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed.

S corporations that have accumulated. Beyond the new corporate tax obligation price there are lots of factors entrepreneurs can gain from choosing a C corp. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

A subsidiary corporation can be subject to the accumulated earnings tax even though the parent corporation is not subject to the accumulated earnings tax and vice versa. 1 Accumulated taxable income is taxable income modified by adjustments in 535b and as reduced by the dividends paid deduction under 561 and the accumulated earnings tax credit under 535c. Then a second tax is paid when those same earnings are distributed as dividends to the shareholders.

Currently shareholders pay individual-level federal income taxes on dividends at a rate not exceeding 238 percent including the 38 percent net investment income tax NIIT. 535b retained in the business in excess of its reasonable needs. Private and publicly held corporations are subject to this tax but it does not impact passive foreign investment companies tax-exempt organizations and personal holding companies.

When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business purpose then IRC 532 provides an accumulated earnings tax that can be assessed on accumulated earnings with no clear business purpose. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and profits to accumulate rather than being paid out.

However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. C Corp Accumulated Earnings And Profits Tax If local business owner are only taking an income that quantity is not tired at the corporate rate shifting the tax formula additionally in their favor.

Accumulated Earnings Tax. The government reasoned that C. Breaking Down Accumulated Earnings Tax.

When the C corporation has current retained or accumulated earnings and profits EP non-liquidating corporate distributions to shareholders are considered as taxable dividends. This is because corporations that do not spend retained earnings are. The Tax Obligation Benefits of C Corporations.

Corporations can be a good option for tool- or higher-risk services those that need to raise money and also companies that prepare to go public or eventually be marketed. A regular corporation or C corporation pays tax on its earnings at the corporate level. The accumulated earnings tax is an annual tax levied on modified taxable income Sec.

An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. The threshold is 25000 without accumulated earning tax.

As a practical matter the tax is col-. Accumulated EP was taxed at the C corporation level and will be taxed again as a dividend to recipient S corporation shareholders when distributed. May 17th 2021.

The accumulated earnings tax is computed on the corporations accumulated taxable income for the taxable year or years in question. The accumulated earnings tax rate is 20. This system of double taxation is precisely the reason why many people choose S corporation status as S Corporations pay no tax on their own at the corporate level.

As the difference between ordinary income tax rates and capital gains tax rates increases corporations have sought to minimize dividend payments to shareholders with the objective of helping them secure capital gains taxed at a lower rate. According to the IRS anything. The IRS also allows certain exemptions based on the required.

The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. This gives very little leeway for C corporations to pay the 21 tax and build up savings without dividends unless there are provable business needs to accumulate more.

S Corporation Or C Corporation Under The Tax Cuts And Jobs Act Pya

Demystifying Irc Section 965 Math The Cpa Journal

What Are Retained Earnings Daily Business

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Retained Earnings Account Is Missing

Determining The Taxability Of S Corporation Distributions Part Ii

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Oh How The Tables May Turn C To S Conversion Considerations Stout

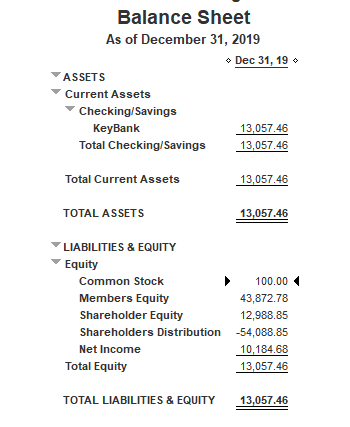

Owners Equity Net Worth And Balance Sheet Book Value Explained

What Are Earnings After Tax Bdc Ca

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Is Corporate Income Double Taxed Tax Policy Center

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Corporate Tax Retur Prepare A Corporate Tax Return Chegg Com

Earnings And Profits Computation Case Study

What Are Accumulated Earnings Definition Meaning Example